japan corporate tax rate 2020

338 Treatment of losses. List of Countries by Corporate Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

The upper limit of the tax credit ratio of 10 is temporarily increased to 14 until 31 March 2021.

. National Income Tax Rates. Local corporation tax applies at 103 on the corporation tax payable. These tools are provided free for your use on the iCalculator website.

This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Corporate Tax Rate. Local management is not required. After 2019 Tax years beginning after 1 Apr 2019 Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in average now in 2021.

Corporation tax is payable at 232. The above amendments will be applied to tax years beginning on or after 1 April 2020. When weighted by GDP the average statutory rate is 2544 percent.

2 Japan tax newsletter 13 February 2020 Corporate taxation 1. National Tax Agency Report 2021 PDF156MB Mutual Agreement Procedures Report 2018 PDF307KB Publication. Comparing Europes Tax Systems.

In addition interest for the late payment of tax is levied at 26 per annum for the first two months and increases to 89 per annum thereafter for the year 2020. Indirect tax rates individual income tax rates employer social security rates and employee social security rates and you can try our interactive tax rates tool to compare tax rates by country jurisdiction or region. Corporate Tax Rates around the World 2020.

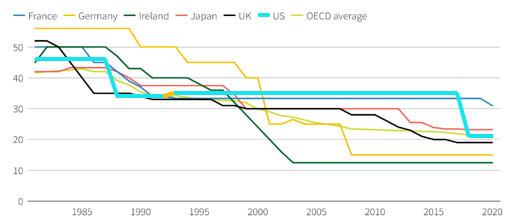

The 2020 Tax Reform Act reviewed the requirements for reporting of overseas property. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9 to 18 million yen. 225 rows The weighted average statutory corporate income tax rate has declined from 4652 percent in 1980 to 2585 percent in 2020 representing a 44 percent reduction over the 40 years surveyed.

Interest on loans however is taxed at a 20 rate. Corporate Taxation in Japan. Asia has the lowest regional average rate at 1962 percent while Africa has the highest regional average statutory rate at 2797 percent.

The tax rates applied to profit and loss sharing groups will be. The deductible portion of a corporations net interest expense to a related party as well as to the third party is restricted to 20 of the adjusted income. Interest on corporate bonds issued by a Japanese company that is paid to a non-resident bondholder either a non-resident company or a non-resident individual is generally subject to Japanese withholding tax at the rate of 15315.

Business tax comprises of regular business tax and size-based business tax. 13 February 2020 Japan tax newsletter Ernst Young Tax Co. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax.

Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34 including local taxes Residence A company that has its principal or main office in Japan is considered to be resident. Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. National Tax Agency 10Y 25Y 50Y MAX Chart Compare Export API Embed Japan Corporate Tax Rate.

Under the 2020 Tax Reform Act the investment threshold was increased from 10 to 30. The penalty is imposed at 5 to 10 once the tax audit notice is received. Dividends interest and royalties earned by non-resident individuals andor foreign corporations are subject to a 20 national WHT under Japanese domestic tax laws in principle.

An exceptional rate of 15 is applied to interest on bank deposits and certain designated financial instruments. The income tax rates allowances thresholds rates and other payroll deductions and allowances displayed on this page are used by the 2020 payroll and tax calculators to calculate relevant tax deductions. KPMGs corporate tax rates table provides a view of corporate tax rates around the world.

2020 Japan tax reform outline. The worldwide average statutory corporate income tax rate measured across 180 jurisdictions is 2354 percent. The latest comprehensive information for - Japan Corporate Tax Rate - including latest news historical data table charts and more.

Tax Rate applicable to fiscal years beginning on or after 1 October 2019 Tax rates for companies with stated capital of more than JPY 100 million are as follows. If the annual taxable earnings do not exceed 30 million yen it is subject to a tax rate of 10. Download the PDF Corporate Income Tax Rates 2018-2022.

The net interest is calculated as interest expense less corresponding interest income. The corporate income tax is a tax on the profits of corporations. However if the taxable earnings exceed this amount a rate of 15 is charged on the amount in excess of 30 million yen and up to 100 million yen and any amount in excess of 100 million yen is taxed at a rate of 20.

All OECD countries levy a tax on corporate profits but the rates and bases vary widely from country to country. RD tax credits permanent measures The tax credit ratio formula was modified as shown in the following table. Revision of the consolidated taxation.

Guidance for Taxpayers on the Mutual Agreement Procedure QA PDF386KB Japans Tax Conventions Including MAP Provisions as of Jan 1 2018 PDF120KB Information for Taxpayers. Data is also available for.

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Doing Business In The United States Federal Tax Issues Pwc

Real Estate Related Taxes And Fees In Japan

Real Estate Related Taxes And Fees In Japan

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Corporate Tax Reform In The Wake Of The Pandemic Itep

일본 법인 세율 1993 2021 데이터 2022 2024 예상

Real Estate Related Taxes And Fees In Japan

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

Real Estate Related Taxes And Fees In Japan

What Would The Tax Rate Be Under A Vat Tax Policy Center

11 Charts On Taxing The Wealthy And Corporations Institute For Policy Studies

Corporation Tax Europe 2021 Statista

Real Estate Related Taxes And Fees In Japan

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Corporate Tax Reform In The Wake Of The Pandemic Itep

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World